We are Your "Global Travel Companions"

Inbound Choice Visitors Insurance

INJURY & SICKNESS MEDICAL INSURANCE FOR VISITORS

Continuous & Renewable Protection. Coverage For Families & Individuals.

ELIGIBILITY

WHO CAN BUY INBOUND® CHOICE?

You are eligible for coverage if you are a non-United States citizen, who

is at least 14 days old or younger than 70 years of age, and traveling to

the U.S. for business, pleasure, to study, or to visit. Your coverage must

become effective within 24 months of your arrival in the United States.

It is your responsibility to maintain all records regarding travel history

and age and provide necessary documents to Seven Corners to verify

eligibility if required.

LENGTH OF COVERAGE

Your coverage length may vary from 5 days to a maximum of 364

days in a policy period. Your total period of coverage cannot exceed

728 days (two 364-day policy periods). You have the option to renew

coverage in any increment of 5 days or more (there is a $5 fee each

time you renew).

coverage start date - Coverage will not begin until you leave your home

country and we receive your application and premium. This is your effective

date.

coverage expiration date - Your coverage ends at 12:01 A.M. North American

Eastern Time on the earlier of the following: the expiration date on your ID card;

the 31st day of your trip to your home country; after completion of 364 days of

coverage, unless the company agrees to extend coverage upon such expiration

(coverage is available up to 2 years); the day you become a U.S. citizen; the date

you enter active military service.

Home Country means the country where your passport was issued.

WHY CHOOSE INBOUND® CHOICE?

You can feel confident with Inbound® Choice’s strong financial backing

through Certain Underwriters at Lloyd’s, London, an established

organization with an AM Best rating of A (Excellent). Your coverage will

be there when you need it.

As your plan administrator, Seven Corners* will handle all of your

insurance needs from start to finish. We will process your purchase,

provide all documents, & handle any claims. In addition, our own 24/7

in-house travel assistance team, Seven Corners Assist, will handle your

emergency or travel needs. We have 20 years of experience with travel

insurance, and we are here to help.

*In California, operating under the name Seven Corners Insurance Services.

IMPORTANT BENEFIT HIGHLIGHTS

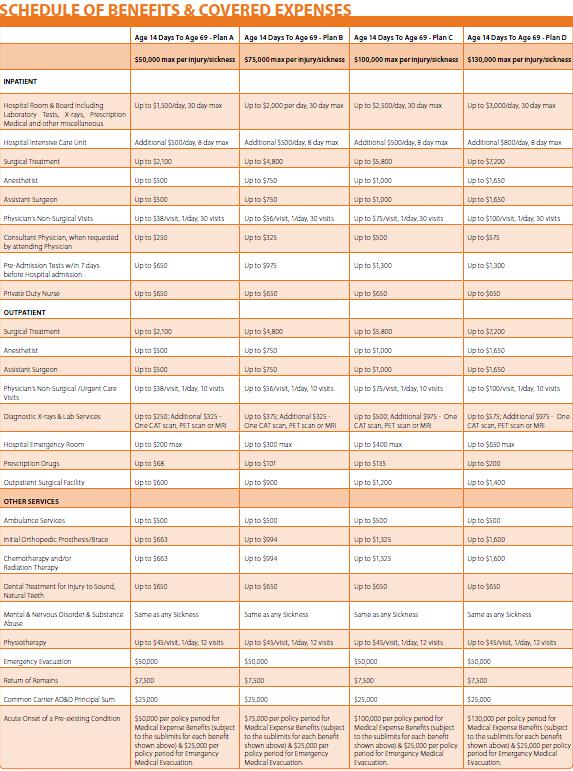

MEDICAL BENEFITS - If your covered injury or sickness requires

medical treatment, we will pay the coverage amounts listed in the

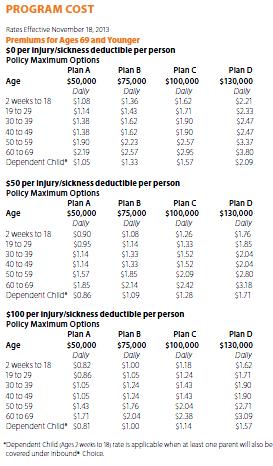

schedule of benefits, minus your chosen per person deductible.

Treatment must be received within 364 days of the injury or sickness.

HOME COUNTRY COVERAGE - We will pay up to $50,000 for an

illness or injury which occurs while you are on an incidental trip to

your home country (30 days per 364 days of purchased coverage or

pro rata thereof, approximately 2½ days per month).

INTERNATIONAL TRAVEL COVERAGE - If you buy at least 30 days of

coverage, you may travel to countries other than the United States for

up to 30 days. This benefit does not include travel back to your home

country, and it does not extend after your current expiration date.

EMERGENCY MEDICAL EVACUATION* - If medically necessary:

1. We will transport you to adequate medical facilities.

2. We will transport you home after receiving medical treatment

related to a medical evacuation.

RETURN OF MORTAL REMAINS* - We will return your remains to

your home country if you should die while traveling.

*Arrangements for evacuation & return of remains must be made by Seven Corners

Assist.

COMMON CARRIER ACCIDENTAL DEATH & DISMEMBERMENT

This benefit pays up to $25,000 for accidents occurring while you

are riding as a passenger in or on any land, water or air conveyance

transporting passengers for hire. Your loss must occur within 365 days

after the accident date. A description of the covered losses is shown

below:

For Loss of: Indemnity:

Life Principal Sum

Both Hands or Both Feet or Sight of

Both Eyes Principal Sum

One Hand and One Foot Principal Sum

Either Hand or Foot and

Sight of One Eye Principal Sum

Either Hand or Foot One-Half the Principal Sum

Sight of One Eye One-Half the Principal Sum

CLAIMS

Filing a claim is easy! Simply send the itemized bill to Seven Corners

within 90 days, along with a completed claim form. Payments can be

converted to a currency of your choosing. You’re only responsible for

your deductible & coinsurance & any non-eligible expenses.

PRE-EXISTING CONDITIONS

Pre-existing conditions are defined in detail in the policy. A brief

summary is shown here.

Pre-existing conditions include any medical condition, sickness, injury,

illness, disease, mental illness or mental nervous disorder that existed

with reasonable medical certainty during the 180 days before your

coverage on Inbound Choice began, whether or not it was previously

manifested, symptomatic, known, diagnosed, treated or disclosed. This

includes but is not limited to any medical condition, sickness, injury,

illness, disease, mental illness or mental nervous disorder for which

medical advice, diagnosis, care or treatment was recommended or

received or for which a reasonably prudent person would have sought

treatment during the 180 days before the effective date.

ACUTE ONSET

Non U.S. Citizens traveling in the United States

We pay up to the specified limit for an acute onset of a pre-existing

condition if the condition occurs in the United States during your coverage

period, & if you receive treatment in the United States within 24 hours of

the sudden & unexpected recurrence. A pre-existing condition that is

chronic, congenital or gradually worsens over time is not covered.

EXCLUSIONS & LIMITATIONS

MEDICAL EXCLUSIONS

See Program Summary for a complete list of exclusions.

• Pre-existing Conditions as defined. If you are a non-U.S. citizen under age

70, this exclusion is waived for an Acute Onset of a Pre-existing Condition

(defined above) as shown in the schedule of benefits for your plan (A, B,

C & D). Benefits will be paid for expenses incurred in the U.S., minus your

deductible & subject to the scheduled limits. All other exclusions apply.

• Any loss occuring while traveling solely for medical treatment, while

on a waiting list for treatment, or while traveling against the advice of a

Physician; expenses which are not medically necessary;

• The maximum benefit is $50,000 for any illness/injury occurring while on an

incidental trip to your home country (home country coverage);

• Routine physicals, inoculations, exams with no objective indications of

impairment of normal health; well-baby care; routine newborn baby care,

well-baby nursery;

• Eye exams & treatment of visual defects; glasses; contact lenses.

• Hearing exams; hearing aids; treatment for hearing defects;

• Dental treatment unless due to injury to sound, natural teeth; false teeth,

dentures; dental appliances;

• Weak, strained or flat feet, corns, calluses, or toenails;

• Cosmetic surgery, or treatment for congenital anomalies (except as

specifically provided), except reconstructive surgery due to a covered

injury or sickness; Correction of a deviated nasal septum is considered

cosmetic surgery unless it results from a covered injury/sickness;

• Elective surgery and elective treatment;

• Treatment, drugs, diagnostic or surgical procedures for infertility,

impotency, artificial insemination, sterilization or reversal thereof, unless

infertility is a result of a covered injury/sickness;

• Birth control, including surgical procedures & devices;

• Injury while participating in professional, sponsored, &/or organized

amateur or intercollegiate athletics;

• Injury while taking part in mountaineering, hang gliding, parachuting,

bungee jumping, racing by horse or motor vehicle or motorcycle,

snowmobiling, motorcycle/motor scooter riding (as a passenger or driver),

scuba diving involving underwater breathing apparatus (unless PADI or

NAUI certified), water skiing, wakeboard riding, jet skiing, windsurfing,

snow skiing & snowboarding;

• Injury or sickness where benefits are payable under Worker’s

Compensation or an Occupational Disease Law or Act;

• Organ & tissue transplants & related services & supplies;

• Any consequence, whether directly or indirectly, proximately or remotely

occasioned by, contributed to by, or traceable to, or arising in connection

with war, invasion, act of foreign enemy hostilities, warlike operations

(whether war be declared or not), or civil war; terrorist activity; nuclear,

chemical, or biological weapons of mass destruction; (additional details

in the policy);

• Suicide or attempted suicide (including drug overdose), while sane or

insane; intentionally self-inflicted Injury;

• Charges of an institution, health service, or infirmary which does not

require payment in the absence of insurance;

• Treatment of nervous or mental disorders; treatment of alcohol, chemical,

or drug addiction, dependency, use or abuse, including illness caused by

such use; injuries related to alcohol, chemicals or drugs unless prescribed

by a physician, except as stated in the schedule of benefits for mental &

nervous disorders;

• Loss from riding in any aircraft, other than as a passenger in an aircraft

licensed for the transportation of passengers;

• Treatment, services, supplies in a hospital owned/operated by: a) The

Veteran’s Administration; or b) A national government or its agencies. (This

exclusion does not apply to treatment you are required by law to pay);

• Duplicate services of a certified nurse-midwife & physician;

• Expenses payable under any prior policy in force for the person making

the claim; expense covered by any other valid & collectible medical,

health or accident insurance;

• A hospital emergency room visit not of an emergency nature;

• Outpatient treatment for the detection or correction by manual or

mechanical means of structural imbalance, distortion or subluxation in the

human body for purposes of removing nerve interference & the effects

thereof, where such interference is the result of or related to distortion,

misalignment or subluxation of or in the vertebral column;

• Injury due to you operating a motor vehicle while not properly licensed

to do so;

• Voluntary or elective abortion;

• Expense incurred after this insurance terminates except as may be

specifically provided;

• Sexually transmitted & venereal diseases & any consequences thereof;

• Treatment incurred by you if you were HIV Positive at the time of

application for this insurance, whether or not you were asymptomatic

or symptomatic or had knowledge of your HIV status on your effective

date or any associated diagnostic tests or charges for HIV infection,

seropositivity to the AIDS virus, AIDS related Illness(es), ARC Syndrome,

AIDS, & all diseases caused by &/or related to HIV;

• Treatment for HIV, the AIDS virus, AIDS related Illness, ARC Syndrome,

AIDS, & all diseases & illnesses caused by &/or related to HIV or arising

as complications from these conditions including the cost of testing for

these conditions &/or charges for drug treatment or surgeries;

• Treatment for tuberculosis, malaria, cholera, dengue fever & parasiticsourced

illnesses, including treatment required as a result of complications

from those same diseases, whether or not previously manifested or

symptomatic prior to your effective date;

• Expenses which are experimental/investigational or for research purposes;

vocational, speech, recreational or music therapy; durable medical

equipment;

• Chiropractic care or complementary medicine including acupuncture and

massage;

• Services/supplies provided by your relative or anyone living with you;

• Treatment of the temporomandibular joint;

• Treatment required as a result of complications or consequences of a

treatment or for a condition not covered under this policy;

• Expenses for home health care, custodial care &/or daily living;

• Expenses for environmental supplies, including handrails, ramps,

special telephones, air conditioners, home delivered meals.

Please be aware that this is not a general health insurance policy, but

an interim program intended for temporary use. We do not guarantee

payment to a facility or individual for medical expenses until we

determine it is an eligible expense.